Everyone who invests in cryptocurrency or is associated with the crypto world has heard the buzzword – DeFi. But what actually is it?

DeFi stands for decentralized finance and is an umbrella term for various financial services on public blockchains. Unlike traditional financial services automated by banks and financial institutions, DeFi isn’t controlled by any central service.

The system’s convenience has allowed many users to earn interest, trade derivatives, and perform related tasks easily. No third party or authority is involved. The technology offers high levels of interest and is also secure.

So, investors and traders are slowly dipping their toes into DeFi. If you want to start using Defi, read on to know about all the essentials.

A Brief Introduction About DeFi

DeFi was designed to disrupt traditional financial intermediaries. It uses blockchain technology, and you can find it on the Ethereum platform.

You can consider it a combination of software development, cryptography, and finance, which aims to give you more control over transactions.

With DeFi, you can perform common financial transactions such as buying insurance, borrowing, earning interest, and trading assets. But here is the catch- there is no central authority or third-party company monitoring these operations.

DeFi is a global peer-to-peer technology that is quite fast and isn’t routed by a centralized system. It means that the transactions occur directly between two people, without any external interference. You don’t even have to worry about complicated paperwork!

How Does It Really Stand Apart?

Some users consider DeFi as a virtual alternative to Wall Street. It’s because the technology cuts out many associated expenses, including banker salaries and trading floors.

- As a result, it creates an open, fair and free financial market where anyone with an internet connection can participate.

- One of the key reasons DeFi works conveniently is due to the smart contract functionality of Ethereum. This functionality executes transactions automatically after meeting a certain condition.

- For instance, if you want to send money, you need to fulfill a specific condition, such as validating a receipt.

- Also, you can lend cryptocurrency easily and earn interest. That’s why lending and borrowing cryptocurrency is extremely popular with DeFi. In addition, you can perform other tasks like working as a liquidity provider for a decentralized institution.

You just need to install DeFi apps to see the technology work its magic! The security is top-notch as no mediator is needed, and the apps are based on Blockchain.

How to Get Started on DeFi?

DeFi has become extremely popular over the years due to its high-interest rates, reliability, and flexibility. It offers more interest than traditional banks.

Here is a step-by-step guide on how to get started with DeFi:

Step 1 – Setting Up Your Wallet

To get started, you will need a cryptocurrency wallet installed on your web browser. It must support different DeFi protocols and Ethereum. There are a wide variety of cryptocurrency wallets to get going, but MetaMask is one of the most popular options.

- Download and install the MetaMask extension on your browser. Then, click on the “Create a Wallet” button.

- You then need to set your password after agreeing to the terms and conditions. This password will be the only access to your account, so try to secure it.

- MetaMask will offer you a seat phrase having 12 random characters. This phrase will come in handy if you’re unable to access your account or your device is damaged.

Step 2 – Buy Ethereum Coins

There are several blockchains to purchase coins. However, Ethereum is the best for DeFi, as it offers you the most features, including smart contracts.

- For buying Ethereum coins, you will have to open an exchange account on platforms such as Coinbase or Gemini. As these platforms require you to enter your bank details, only select reputed sites.

- Another way to buy ETH coins is to use the MetaMask extension. After you click on the deposit option in MetaMask, you’ll see all the available ways to buy ETH, like CoinSwitch and Wyre. Select the option of your choice, and click on buy.

Step 3 – Enter the World of Defi

Now that the basics are settled, you can play around and explore the world of DeFi. You can start by investing your funds in a decentralized exchange (Dex). It is a peer-to-peer cryptocurrency exchange that offers you secure online transactions with no intermediaries involved.

Using a Dex, you can become a market maker and begin earning money! In addition, you can also lend out your crypto to friends and relatives. You’ll be called a yield farmer, where you’ll receive governance tokens for lending out your crypto.

Best DeFi Platforms

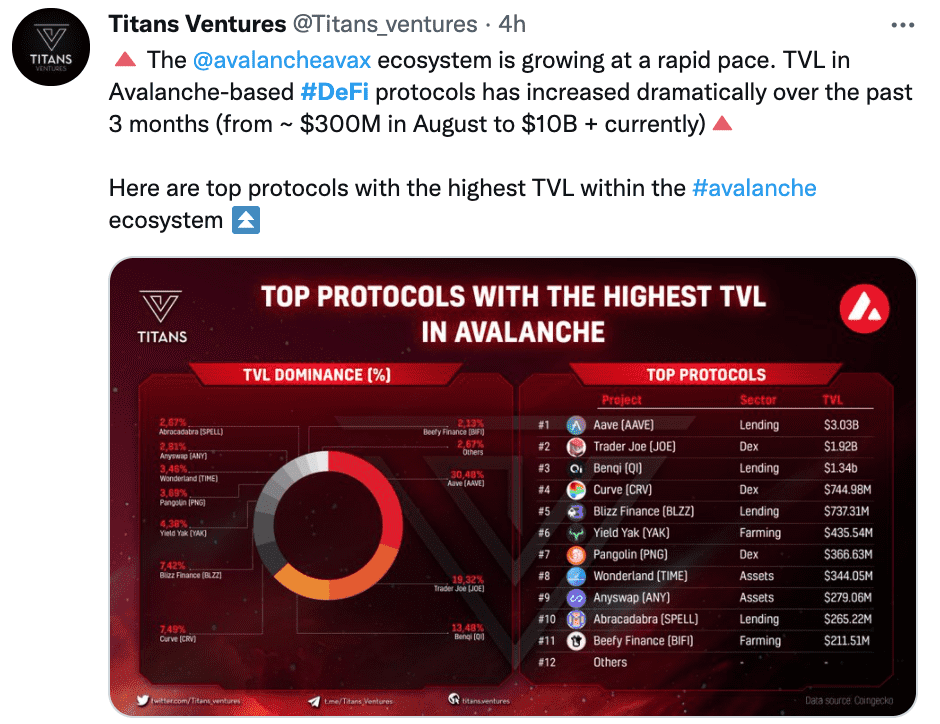

DeFi markets have seen a significant rise in recent years as most users have enjoyed their exciting features and convenience. Its market capitalization has gone over $128 billion and is expected to rise even further.

All this growth is due to the various DeFi platforms which have entered the market. Let’s check out the top platforms making the rounds in the industry.

BlockFi

BlockFi is the ideal platform for beginners who are transitioning from traditional finance options to crypto.

With a BlockFi interest account, you can get 3 to 8.6% interest for cryptocurrency holdings. There are no minimum balance requirements, hidden fees, or transaction fees here.

You can also borrow funds against your cryptocurrency assets in USD whenever you want. The interest rates are as low as 4.5%. Moreover, you won’t have problems like reporting capital gains, as you save money on taxes.

The best part? BlockFi offers a Bitcoin rewards credit card that earns back 1.5% on Bitcoin purchases.

Pros

- No monthly fees, minimum deposits, or commission fees

- Regulated by the US government and accepted worldwide

- It lets you borrow funds at low-interest rates

- Offers recurring trade account

Cons

- Only one free stablecoin and crypto withdrawal

- No custodial accounts

Gemini

Gemini is another platform targeted at beginner and experienced investors alike, offering more than 26 tokens and coins. Having a very user-friendly interface for mobile and web applications, it suits all types of traders.

For long-term investment, you can set up an interest-bearing crypto account. The annual interest rate is 2 to 7.4%, which is added to the paper currency in your account. In addition, you get to choose from more than 48 cryptocurrencies, which allows you to experiment and earn more.

Gemini safeguards all your digital assets through multilayered security features. The platform protects your earnings from security breaches, hackers, and unauthorized access.

Pros

- Over 48 cryptocurrencies to experiment

- You can earn up to 7.4% APY with Gemini Earn on your crypto balance

- Easy sign UPS to get started in minutes

- Hot wallets come with insurance to protect your data from security breaches.

Cons

- Transaction and convenience fees are high for buying or selling crypto

- It might not be suitable for novices

Even after considering their differences, both these platforms are well-suited for newcomers and intermediate traders. Their diverse cryptocurrency options and security features set them apart from many platforms.

Here are some other DeFi platforms to check out –

Aave

It is a decentralized platform that enables you to borrow and lend digital assets. If you want to earn rewards and discounts, you can stake the AAVE coin on the platform.

It was one of the earliest DeFi platforms in the industry, which brought together lenders and borrowers to work efficiently. On this non-custodial platform, any user can participate as a borrower or a depositor, adding to the convenience.

Uniswap

This is one of the biggest DeFi platforms which allows you to purchase and provide liquidity from your Crypto wallets at nominal expenses. The fees for listing coins are almost none, and you can control funds security and effortlessly.

The platform offers two major smart contracts – the factory and the smart exchange contract. The factory contract adds new tokens, whereas the exchange contract offers to trade and swap tokens easily.

Compound

This is yet another DeFi platform that is open-source and offers you a seamless crypto experience. Compound runs on Ethereum and allows you to access the liquidity pool for depositing various Crypto coins. You can borrow or lend against your Crypto collaterals.

In addition, the smart contract feature allows the platform’s protocol to regulate the rates according to demand and supply. Users can earn interests easily from the liquidity pool.

Moreover, you can also offer loans by locking your Crypto assets with the protocol.

Top Crypto Platforms to Get Started

Get started with the two best platforms of all time: BlockFi and Gemini.

BlockFi | Gemini |

BlockFi is best recommended for those who:

| Gemini is best recommended for those who:

|

Pros of BlockFi

| Pros of Gemini

|

Cons Of BlockFi

| Cons Of Gemini

|

To Wrap Up

DeFi lets users access their cryptocurrency accounts from anywhere in the world. Additionally, they don’t have to worry about penalties or fees issued by traditional financial institutions.

As the crypto market is booming, using DeFi for lending or borrowing crypto might be a good option. By using the DeFi apps, you can generate a steady passive income by learning about your crypto and collecting interest.

So, start experimenting with the DeFi apps and get your hands dirty with DeFi!

If you get stuck, you can always check our handy guide for reference.